BRANCH CLOSURES FREQUENTLY ASKED QUESTIONS AND ANSWERS

Why is Core Credit Union closing Dalkey & Foxrock branches?

• Our income comes from Loan Interest Income and Investment income. With fewer members borrowing and Central Bank’s negative interest rates our income has been dramatically reduced.

• In both Dalkey and Foxrock only 1 out of 8 adult members are borrowing, compared to 1 out of 4 in other branches

• The low interest rate environment has caused a drop of almost €2.5 million a year in investment income. In context our total Income is €5 million a year and this drop represents 1/3 of what our total income would have been in the past

• Additional regulation since the banking crisis has increased costs significantly although our mergers allowed us manage the costs which helped defer this decision

Did you take any steps to avoid having to close branches?

We have been very active to try to avoid the need to close offices

• For several years, we have been lobbying local politicians to explain to them that without political action we would end up in this position.

• Our mergers were motivated to help keep as many services as possible. Without the mergers these branches would have closed sooner, and members would not have been part of a large network of branches with full online services.

• We have cut costs wherever possible in the last number of years and will be continuing to do so.

• Our mergers allowed us to introduce mortgages, current accounts, and new insurances. All of these are helping and are putting the credit union in a very strong position for the future. Unfortunately, the impact of external factors such as the low interest rate environment have outweighed our great work to date.

Do I need to join another branch if my local branch is closing?

No. You still have access to 5 branches all of which are near our members. You can also call our member services on 01-2725600 to carry out your business over the phone or register for your secure account online and access the credit union 24/7.

Does this mean the credit union is in difficulty?

No. Core Credit Union has always prided itself as being a safe, stable and financially sound credit union in which you can borrow and save with confidence. This decision was taken to ensure we remain as a safe and strong credit union.

Will I be notified of the branch closures?

We have written to all members who regularly use the Dalkey or Foxrock branches to inform them of the closures and informed them of their nearest alternative branch. All members continue to have access to our extensive branch network, members services centre and secure fintech apps on online accounts.

Does this mean the credit union cannot give out loans?

We have a fund of over €80 million available for lending and encourage our members to borrow from us. Doing so will strengthen us and ensure that we can remain present in the community.

What are you doing to reduce the impact on service to members in the areas affected?

We have taken the following measures to reduce the inconvenience of the branch closure on members affected.

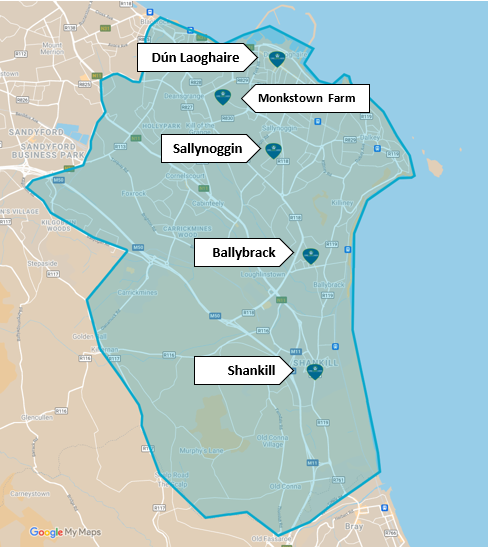

• Most members are less than 3kms from another branch of Core Credit Union.

• We have a member services centre which can deal with your enquiries over the phone on 01-2725600, by email on members@corecu.ie or by webchat on our website.

• Members can drawdown loans from anywhere using our secure website and digital signatures

• Members can make payments to the credit union over the phone or online

• Through our mobile apps and website members can access the credit union safely and securely 24/7

• Our current accounts allow members transact with the credit union worldwide

Are my savings safe here?

Yes. We have over €18 million in reserves which makes us a very strong credit union. Keeping your savings safe is our number 1 priority. In addition all savings are covered by the Deposit Guarantee Scheme.

Are you committed to face to face service?

Yes. While more of our members choose to use our fintech solutions we believe that all members have a need, even if that need is infrequent, to visit a branch. We intend to keep as many branches open as we can. If more members borrow from us this will be easy to do.

You are opening a new branch in Dún Laoghaire, why?

We are excited to be moving to a more vibrant location in Dún Laoghaire and hope that this will bring in more members and business thereby strengthening the Credit Union. This is also a reflection of our commitment to maintaining a strong branch network.The current branch in Sussex Street is far too big for our current needs.