Core Credit Union offers Life Savings Insurance at no direct cost to eligible members. This benefit is funded by the Credit Union and does not require any application. It provides a top-up on your savings upon your passing, based on your age and savings balance at the time of death.

How It Works

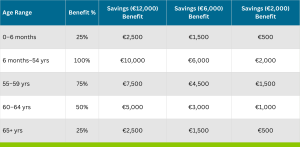

Based on the saving and age at death, CCU will top up your savings – up to a maximum of €10,000 in benefit provided CCU has not withdrawn the LS.

The table below outlines the maximum benefits available to your loved ones (paid in addition to your saving and any other benefit you may have.) based on a sample savings balance of €12,000, €6,000 and €2,000

Key Features

- Simple & Transparent: No complex history tracking—only your balance and age at death matter.

- No Penalty for Withdrawals: Reducing and replenishing savings does not affect your benefit.

- Natural Persons Only: Trustees or associations do not qualify.

Pre-existing Condition Limitation (PCL)

- Deposits made within 6 months of death are not covered if death results from a pre-existing condition.

- Deposits older than 6 months are covered.

Important Terms & Conditions

- The qualifying member has no contract with Core Credit Union or Insurance provider for this benefit. Core Credit Union has a contract with insurer. There is no contractual relationship whatsoever between member and Core Credit Union for this benefit.

- The Board of Core Credit Union may cancel the benefit at any time and there is no concept of an accrued benefit arising. The Board have sole authority on this matter and there is no basis for any appeals.

- Core Credit Union can only retain insurance so long as there are adequate surpluses to pay for the benefit. This means that there is no guarantee that LS can continue indefinitely, but if a qualifying member dies before it is withdrawn, the benefit will be paid.

- Qualifying Member must be under 70 when the share account is opened and can save up to the day they pass, no cut-off at age 70 years.

- Pre-existing Condition Limitation: The insurance does not cover every deposit if a member dies from a pre-existing illness or injury for which medical advice, consultation or treatment was received in the 6 months before the date of deposit. All deposits older than 6 months are covered.

- LS applies in aggregate to the combined balances that a member may have. For the avoidance of doubt, where a member passes the total of a joint account is taken into consideration, but the limit applies to €10,000 in balances with the % payout depending on age in the table above.

- Only natural persons can be qualifying member and trustees of unincorporated associations in that capacity do not qualify as qualifying members for the purpose of LS.

- Payouts are based on the age of qualifying member at date of death and is based on table above. For example, the maximum payout to member passing away over 65 is €2,500 based on maximum of 25% of a qualifying balance at or over €10,000.

- The amount payable will be added to member’s account and will be taken into account for the purposes of nomination under S21 Credit Union Acts 1997-2023. This amount does not constitute a lodgement for the purposes of the benefit.

- If a Member dies by suicide, the Board shall determine entitlement to LS benefit and shall direct that all communications be conducted with due sensitivity and confidentiality.