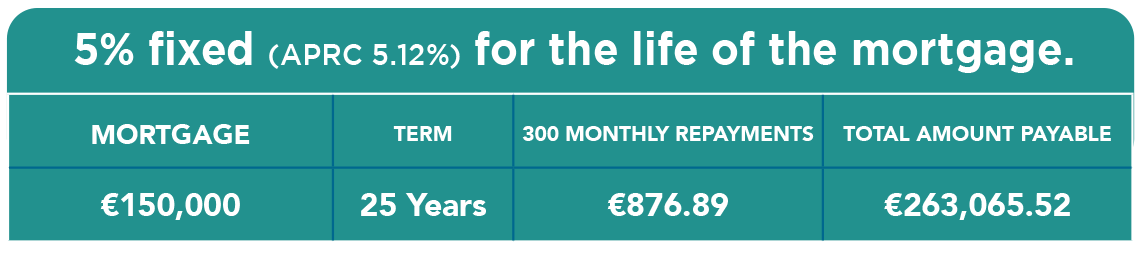

Are you caught with a high interest rate mortgage?

Then maybe we have solution for you.

Check out if one of the scenarios below might relate to you.

Scenario 1 – Your current arrears are caused by recent increase in interest rates.

Scenario 2 – Historic Arrears

You should consider switching your mortgage to Core Credit Union where you will have someone to talk to and work through your options.

Questions to ask yourself?

• Has your financial situation recovered?

• Are your household incomes reasonably good and can you show the ability to pay off your mortgage with Core Credit Union?

• Do you meet our standard lending requirements?

A full assessment will be carried out by your credit union factoring in your circumstances. Like all loans with your credit union we endeavour to find solutions for you if possible.

For an appointment to speak to one of our Loan Officers please complete the contact form below or if you have any specific Mortgage query, please email members@corecu.ie or you can also call: 01 272 5600